Microfinance Market , by Providers, End-use (Small enterprises, Micro enterprises, Solo entrepreneurs), Purpose (Agriculture, Manufacturing , Trade & services, Household), Tenure and Region - Partner & Customer Ecosystem (Product Services, Proposition & Key Features) Competitive Index & Regional Footprints by MarketDigits - Forecast 2024-2032

Industry : FMCG | Pages : 182 Pages | Published On : May 2024

Market Overview

Microfinance is a type of financial service that low-income groups and individual ineligible for conventional financing options can obtain to satisfy their needs. Apart from lending smaller amounts to borrowers with easy eligibility conditions, many financial institutions also offer micro-savings accounts to benefit the account holders. The goal is to make impoverished people financially self-sufficient. Apart from SME loans, borrowers can also obtain instant Personal Loans to fulfil their personal needs like education, home renovation, medical emergency, vacation, or wedding. Recognizing area of the existing policies to cater to inferior people’s needs, the Indian government took steps to reduce their financial dependence on unorganized sectors. There are small-size, short-duration loans available without security and lengthy application procedures. it provides economic resilience, helping individuals and business owners work effectively and alleviate poverty. Business owners can use these loans to run and expand their businesses and accumulate capital for future needs. Since those looking for smaller loans do not attract the interest of most lenders, small loan sanctions from microfinance are great steps to gain financial independence. Female borrowers get better interest rates on these loans due to their higher sense of responsibility, loyalty, and honesty. Unemployed and disabled people and those who do not qualify for conventional loans can receive these loan products from MFIs.

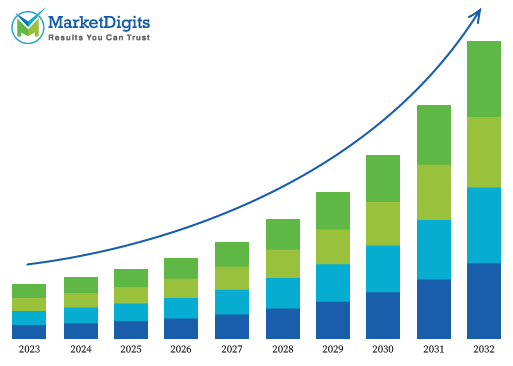

Microfinance Market Size

| Report | Details |

|---|---|

| Market Size Value | USD 9.35 billion in 2024 |

| Market Size Value | USD 13.3 billion by 2030 |

| CAGR | CAGR of 5.2% |

| Forecast Period | 2024-2032 |

| Base Year | 2023 |

| Historic Data | 2020 |

| Segments Covered | Providers, End-use, Purpose, Tenure and Region |

| Geographics Covered | North America, Europe, Asia Pacific, and RoW |

Microfinance breaks the cycle of financial crunch in a family or business and makes more money available, helping them meet their basic needs and improve their well-being. When entrepreneurs borrow microfinance, they create more employment opportunities in the economy and help the nation develop faster. helps people obtain loans without pledging any asset as security. The importance of microfinance, eligible applicants can enjoy the benefits with hassle-free procedures and minimal paperwork, enabling them to gain self-dependence quickly.

Major vendors in the global Microfinance Market are 51Give, Al Amana Microfinance, Al Rajhi bank , Al-Barakah Microfinance Bank, Alinma bank, Annapurna Finance (P) Ltd, Asirvad Microfinance Pvt. Ltd., Banco do Nordeste do Brasil S.A., Bank Albilad, Bank Rakyat Indonesia, BRAC, BSS Microfinance Ltd., Grameen Foundation, Kiva, Riyad Bank and others.

Additional consideration apart from savings

The poor exhibit resourcefulness by employing various informal savings methods, including storing cash and livestock. However, these methods come with risks and expenses, particularly in the case of livestock. And deeper into the crucial role of savings for the poor, emphasizing its necessity for covering significant expenses like weddings, funerals, school fees, and investment opportunities. By exploring savings tools that enable them to store money, we aim to address the challenges posed by unpredictable income fluctuations and periods without income. While banks offer a secure and formal means of building funds through savings accounts, accessing the commercial banking sector can be challenging for the poor due to physical and financial constraints. Rural villages often lack convenient bank branches, and minimum deposit requirements pose obstacles.

Market Dynamics

Drivers:

- Growing Importance of digitalization for traditional MFI

- Improves financial inclusion

- Provides emergency funds

- Encourages entrepreneurship

Opportunities:

- Technological advancements

- Focus on social and sustainability impact

- Digitalization raises data security concerns

- Growing significance of block-chain

Artificial Intelligence Poised to Transform the future of Microfinance

AI promises to completely transform everything some things more than others. The BFSI space has already seen the sheer efficiency of AI to process massive data logs and deliver masterful insights through pattern recognition. AI has made a huge difference in the world of payments and financial services which is plagued with incidences of identity fraud and imposter scams. With the need to deliver better experiences and customer conveniences, AI enables better and faster fraud detection in a hyper-digitised world where PII (Personally Identifiable Information) is available for a few hundred dollars on the dark web. Advanced risk monitoring and fraud detection enables prediction and detection in real-time and not post factum.

North America dominates the market for Microfinance.

North America stands out as the dominating region in the global Microfinance Market, with the United States leading in consumption and market share. The region's dominance can be attributed to waste water reclamation system makes it possible for the company to save 40 gallons of water per every case of glove produced, and running the plant with clean burning liquefied natural gas (LNG) reduces the carbon footprint of the manufacturing facility, especially as compared to coal-burning power plants, which are all too often the standard within the greater industry.

Asia-Pacific, and specifically India, is emerging as a key player with substantial growth potential in the Microfinance Market. India has the largest microfinance market globally, followed by Bangladesh. The Government of India (GoI) is continuously striving in the promotion of financial annexation in the banking sector through initiatives that are targeted primarily to bring the India’s underbanked population under the banking array.

Another noteworthy region is the Middle East and Africa, where the demand for convenient financial solutions is on the rise due to changing lifestyles and an expanding working-class population. South Africa, in particular, showcases promise as a market with high growth potential, driven by urbanization and a growing awareness of convenient options.

Digital microfinance in rural areas is in growing trend

Digital financial services (DFS) lies at the heart of financial inclusion in India. Despite the government’s efforts to create interconnected digital infrastructure, the adoption of DFS in rural areas is marred by digital illiteracy, which has a direct bearing on the acceptance of digital products. E-commerce has gained traction among rural consumers in recent years. Banks and private companies are establishing a network of rural entrepreneurs to create a one-stop-shop for the financial needs of rural customers and help them shop online via digital platforms with built-in digital payment modes.

Major Segmentations Are Distributed as follows:

- By Providers

- Banks

- Micro Finance Institute (MFI)

- NBFC (Non-banking financial institute)

- By End-use

- Small enterprises

- Micro enterprises

- Solo entrepreneurs

- By Purpose

- Agriculture

- Manufacturing

- Trade & services

- Household

- By Tenure

- Less than 1 year

- 1-2 years

- More than 2 years

- By Region

- North America

- US

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Rest of Latin America

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Russia

- BENELUX

- CIS & Russia

- Nordics

- Austria

- Poland

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Indonesia

- Malaysia

- Vietnam

- Australia & New Zealand

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Nigeria

- Egypt

- Israel

- Turkey

- Rest of Middle East & Africa

- North America

Recent Developments

- In January 2024, Muthoot Microfin lowers lending rates by 55bps

Muthoot Microfin has decided to reduce lending rates by up to 55 basis points on fresh loans to existing customers. This move comes after nearly two years of upward movement in loan rates. The reduction in rates will not affect the lender's net interest margin, which rose to 12.6% for the December 2023 quarter.

Microfinance Market Report Gives Answers to Following Key Questions:

- What will be the Microfinance Market ’s Trends & growth rate? What analysis has been done of the prices, sales, and volume of the top producers of Microfinance Market?

- What are the main forces behind the worldwide Microfinance Market? Which companies dominate the Microfinance Market?

- Which companies dominate the Microfinance Market? Which business possibilities, dangers, and tactics did they embrace in the market?

- What are the global Microfinance industry's suppliers' opportunities and dangers in Microfinance Market?

- What is the Microfinance industry's regional sales, income, and pricing analysis? In the Microfinance Market, who are the distributors, traders, and resellers?

- What are the main geographic areas for various trades that are anticipated to have astounding expansion over the Microfinance Market?

- What are the main geographical areas for various industries that are anticipated to observe an astounding expansion in Microfinance Market?

- What are the dominant revenue-generating regions for Microfinance Market, as well as regional growth trends?

- By the end of the forecast period, what will the market size and growth rate be?

- What are the main Microfinance Market trends that are influencing the market's expansion?

- Which key product categories dominate the Microfinance Market? What are the Microfinance Market ’s main applications?

- In the coming years, which Microfinance Market technology will dominate the market?

Reason to purchase this Microfinance Market Report:

- Determine prospective investment areas based on a detailed trend analysis of the global Microfinance Market over the next years.

- Gain an in-depth understanding of the underlying factors driving demand for different Microfinance Market segments in the top spending countries across the world and identify the opportunities each offers.

- Strengthen your understanding of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- Identify the major channels that are driving the global Microfinance Market, providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- Channelize resources by focusing on the ongoing programs that are being undertaken by the different countries within the global Microfinance Market.

- Make correct business decisions based on a thorough analysis of the total competitive landscape of the sector with detailed profiles of the top Microfinance Market providers worldwide, including information about their products, alliances, recent contract wins, and financial analysis wherever available.

TOC

Table and Figures

Methodology:

At MarketDigits, we take immense pride in our 360° Research Methodology, which serves as the cornerstone of our research process. It represents a rigorous and comprehensive approach that goes beyond traditional methods to provide a holistic understanding of industry dynamics.

This methodology is built upon the integration of all seven research methodologies developed by MarketDigits, a renowned global research and consulting firm. By leveraging the collective strength of these methodologies, we are able to deliver a 360° view of the challenges, trends, and issues impacting your industry.

The first step of our 360° Research Methodology™ involves conducting extensive primary research, which involves gathering first-hand information through interviews, surveys, and interactions with industry experts, key stakeholders, and market participants. This approach enables us to gather valuable insights and perspectives directly from the source.

Secondary research is another crucial component of our methodology. It involves a deep dive into various data sources, including industry reports, market databases, scholarly articles, and regulatory documents. This helps us gather a wide range of information, validate findings, and provide a comprehensive understanding of the industry landscape.

Furthermore, our methodology incorporates technology-based research techniques, such as data mining, text analytics, and predictive modelling, to uncover hidden patterns, correlations, and trends within the data. This data-driven approach enhances the accuracy and reliability of our analysis, enabling us to make informed and actionable recommendations.

In addition, our analysts bring their industry expertise and domain knowledge to bear on the research process. Their deep understanding of market dynamics, emerging trends, and future prospects allows for insightful interpretation of the data and identification of strategic opportunities.

To ensure the highest level of quality and reliability, our research process undergoes rigorous validation and verification. This includes cross-referencing and triangulation of data from multiple sources, as well as peer reviews and expert consultations.

The result of our 360° Research Methodology is a comprehensive and robust research report that empowers you to make well-informed business decisions. It provides a panoramic view of the industry landscape, helping you navigate challenges, seize opportunities, and stay ahead of the competition.

In summary, our 360° Research Methodology is designed to provide you with a deep understanding of your industry by integrating various research techniques, industry expertise, and data-driven analysis. It ensures that every business decision you make is based on a well-triangulated and comprehensive research experience.

• Product Planning Strategy

• New Product Stratergy

• Expanded Research Scope

• Comprehensive Research

• Strategic Consulting

• Provocative and pragmatic

• Accelerate Revenue & Growth

• Evaluate the competitive landscape

• Optimize your partner network

• Analyzing industries

• Mapping trends

• Strategizing growth

• Implementing plans

Covered Key Topics

Growth Opportunities

Market Growth Drivers

Leading Market Players

Company Market Share

Market Size and Growth Rate

Market Trend and Technological

Research Assistance

We will be happy to help you find what you need. Please call us or write to us:

+1 510-730-3200 (USA Number)

Email: sales@marketdigits.com