- Home

- Energy & Power

-

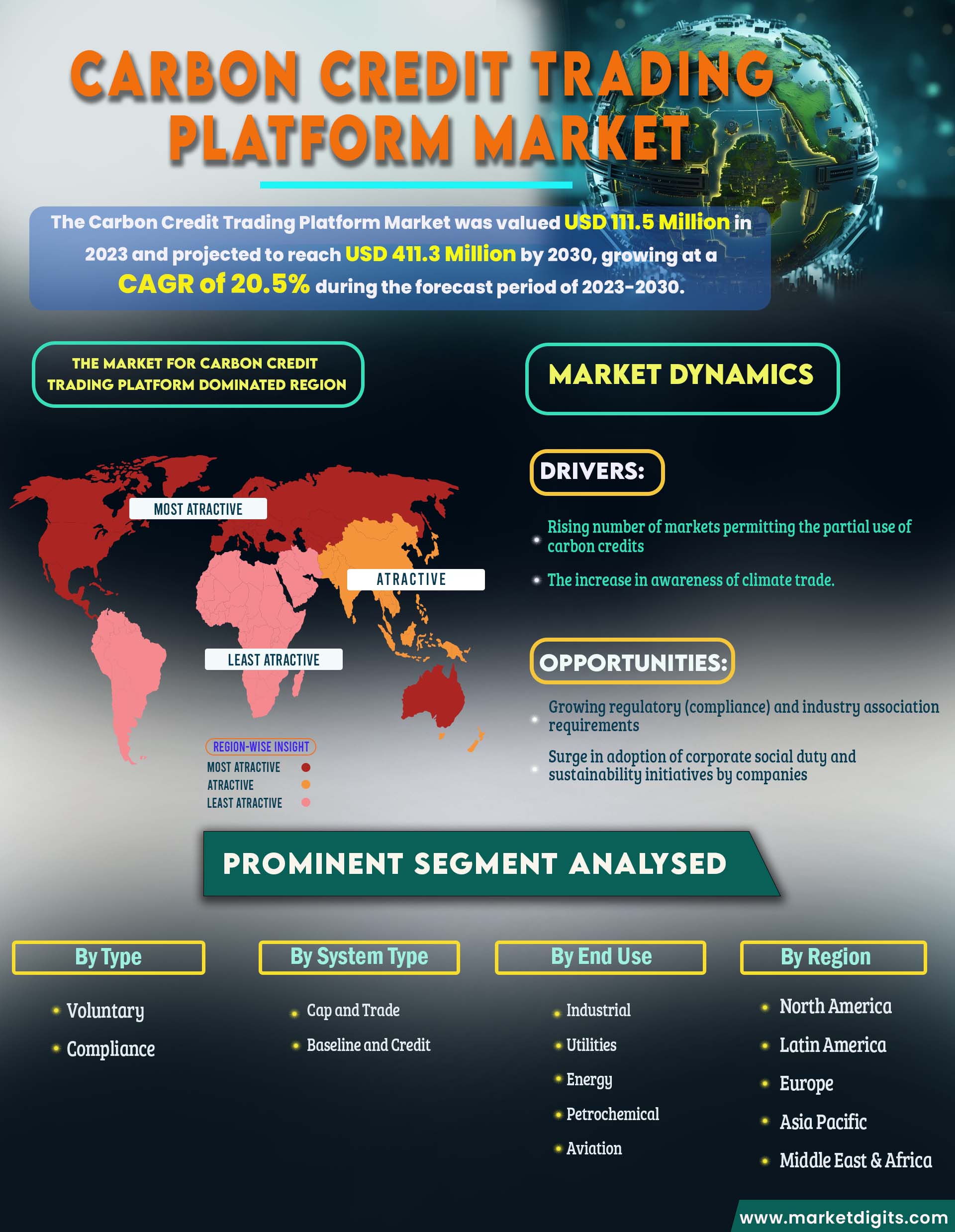

Carbon Credit Trading Platform Market

Carbon Credit Trading Platform Market by Type (Voluntary, Compliance), System Type (Cap and Trade, Baseline and Credit), End Use (Industrial, Utilities, Energy, Petrochemical, Aviation), and Region - Partner & Customer Ecosystem (Product Services, Proposition & Key Features) Competitive Index & Regional Footprints by MarketDigits - Forecast 2024-2032

Industry : Energy & Power | Pages : 195 Pages | Published On : Apr 2024

Market Overview

The Carbon Credit Trading Platform Market is a pivotal component of global efforts to mitigate climate change, offering a platform for the buying and selling of carbon credits, which represent emission reductions or removals. This market addresses the growing demand for sustainable practices by facilitating transactions between entities seeking to offset their carbon footprint and those generating carbon credits through eco-friendly initiatives. With increasing environmental awareness and regulatory frameworks promoting carbon neutrality, the market has witnessed substantial growth. Key players provide digital platforms that streamline the trading process, ensuring transparency and efficiency. The market's evolution is propelled by the urgent need to combat climate change, making carbon credit trading a vital mechanism in the transition towards a more sustainable and low-carbon global economy.

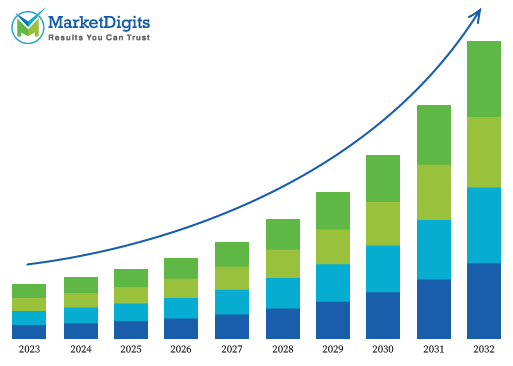

Carbon Credit Trading Platform Market Size

| Report | Details |

|---|---|

| Market Size Value | USD 132 billion in 2024 |

| Market Size Value | USD 948.6 billion by 2030 |

| CAGR | CAGR of 24.50% |

| Forecast Period | 2024-2032 |

| Base Year | 2023 |

| Historic Data | 2020 |

| Segments Covered | Type, System Type, End Use |

| Geographics Covered | North America, Europe, Asia Pacific, and RoW |

Major vendors in the global Carbon Credit Trading Platform Market are AirCarbon Exchange, BetaCarbon, Carbon Credit Capital, Carbon Trade Exchange, Carbonex, Carbonplace, Climate Impact X, ClimateTrade, CME Group, EEX Group, Flowcarbon, Likvidi, MOSS.Earth, Nasdaq Inc., PathZero, Planetly, Public Investment Fund, South Pole, Toucan, Xpansiv, and others.

Rising number of markets permitting the partial use of carbon credits

The Carbon Credit Trading Platform Market is witnessing significant growth driven by the increasing number of markets permitting the partial use of carbon credits. This trend reflects a global shift towards more flexible and sustainable approaches to emissions reduction. As regulatory frameworks evolve, more markets recognize the value of carbon credits in achieving environmental goals. The allowance for partial use provides organizations with a practical means to offset their carbon footprint, fostering wider participation in carbon credit trading. This driver not only encourages businesses to adopt eco-friendly practices but also enhances the overall effectiveness of carbon credit markets in addressing climate change. The rising acceptance of partial carbon credit utilization underscores a collective commitment to building a more resilient and sustainable global economy.

Market Dynamics

Drivers:

- Rising number of markets permitting the partial use of carbon credits

- The increase in awareness of climate trade.

Opportunities:

- Growing regulatory (compliance) and industry association requirements

- Surge in adoption of corporate social duty and sustainability initiatives by companies

Growing regulatory (compliance) and industry association requirements

The Carbon Credit Trading Platform Market is presented with a significant opportunity due to the growing regulatory and industry association requirements. As governments worldwide intensify efforts to combat climate change, stringent regulations and compliance standards are emerging, mandating businesses to offset their carbon emissions. Industry associations are also increasingly advocating for sustainable practices. This presents an opportunity for the carbon credit trading platform market to serve as a crucial tool for organizations to meet these compliance requirements efficiently. By providing a transparent and streamlined platform for carbon credit transactions, these markets empower businesses to navigate regulatory complexities, ensuring adherence to environmental mandates. The market's alignment with evolving compliance needs positions it as a key enabler for businesses striving to achieve environmental sustainability while fostering a proactive and responsible approach towards carbon footprint reduction.

The market for Carbon Credit Trading Platform is dominated by North America.

The Carbon Credit Trading Platform market is predominantly led by North America, with the United States and Canada playing pivotal roles in shaping this dominance. In the United States, a growing emphasis on sustainability, coupled with the Biden administration's commitment to rejoining the Paris Agreement, has spurred increased interest in carbon credit trading platforms. The U.S. has witnessed a surge in corporate initiatives and regulatory measures, fostering the demand for carbon credits to achieve carbon neutrality goals. Similarly, in Canada, a robust carbon pricing framework and the federal government's commitment to achieving net-zero emissions by 2050 contribute to the market's dominance. Both countries boast a strong culture of environmental responsibility, driving the adoption of carbon credit trading platforms as essential tools in the transition towards a more sustainable and low-carbon future in North America.

The voluntary Segment is Anticipated to Hold the Largest Market Share During the Forecast Period

Based on Type the Carbon Credit Trading Platform market is segmented into Voluntary and Compliance. In 2022, the voluntary segment has asserted its dominance in the Carbon Credit Trading Platform market share. The voluntary carbon credit market, driven by corporate sustainability initiatives and a growing global focus on environmental responsibility, has experienced significant expansion. Companies across various industries are proactively engaging in voluntary carbon credit trading to offset their emissions and demonstrate commitment to environmental stewardship. This segment is characterized by a diverse range of participants, including corporations, non-profits, and individual consumers, contributing to a vibrant and dynamic marketplace. The voluntary nature allows for greater flexibility and creativity in carbon credit transactions, fostering innovation in sustainable practices. As businesses increasingly prioritize ESG goals, the voluntary segment's dominance reflects a fundamental shift towards conscientious and proactive environmental action on a global scale, with carbon credit trading platforms serving as instrumental facilitators in this transformative journey.

Major Segmentations Are Distributed as follows:

- By Type:

- Voluntary

- Compliance

- By System Type:

- Cap and Trade

- Baseline and Credit

- By End Use:

- Industrial

- Utilities

- Energy

- Petrochemical

- Aviation

- By Region

- North America

- U.S.

- Canada

- Latin America

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

- Peru

- Rest of Latin America

- Europe

- Germany

- France

- Italy

- Spain

- U.K.

- BENELUX

- CIS & Russia

- Nordics

- Austria

- Poland

- Rest of Europe

- Asia Pacific

- North America

-

- China

- Japan

- South Korea

- India

- Thailand

- Indonesia

- Malaysia

- Vietnam

- Australia & New Zealand

- Rest of Asia Pacific

-

- Middle East & Africa

-

- Saudi Arabia

- UAE

- South Africa

- Nigeria

- Egypt

- Israel

- Turkey

- Rest of MEA

Recent Developments

- In July 2022, Aircarbon exchange (ACX), signed a collaboration agreement with the Nairobi international financial center (NIFC) and the Nairobi Securities Exchange (NSE) to develop a Kenya carbon exchange during the official launch of the Nairobi international financial center (NIFC). The partnership will establish a carbon ecosystem in Kenya connected to ACX’s international client order book, allowing buyers and sellers, international and domestic, to transact efficiently and transparently.

- In September 2021, CTX & IBAC –Partnership to support Business Aviation Voluntary Commitments on Climate Change. The International Business Aviation Council (IBAC) represents over 18,000 operators worldwide on Aviation emissions reductions.

Answers to Following Key Questions:

- What will be the Carbon Credit Trading Platform Market’s Trends & growth rate? What analysis has been done of the prices, sales, and volume of the top producers in the Carbon Credit Trading Platform Market?

- What are the main forces behind worldwide Carbon Credit Trading Platform Market? Which companies dominate Carbon Credit Trading Platform Market?

- Which companies dominate Carbon Credit Trading Platform Market? Which business possibilities, dangers, and tactics did they embrace in the market?

- What are the global Carbon Credit Trading Platform Engines industry's suppliers' opportunities and dangers in Carbon Credit Trading Platform Market?

- What is the global Carbon Credit Trading Platform industry's regional sales, income, and pricing analysis? In the Carbon Credit Trading Platform Market, who are the distributors, traders, and resellers?

- What are the main geographic areas for various trades that are anticipated to have astounding expansion over the Carbon Credit Trading Platform Market?

- What are the main geographical areas for various industries that are anticipated to observe astounding expansion for Carbon Credit Trading Platform Market?

- What are the dominant revenue-generating regions for Carbon Credit Trading Platform Market, as well as regional growth trends?

- By the end of the forecast period, what will the market size and growth rate be?

- What are the main Carbon Credit Trading Platform Market trends that are influencing the market's expansion?

- Which key product categories dominate Carbon Credit Trading Platform Market? What is Carbon Credit Trading Platform Market’s main applications?

- In the coming years, which Carbon Credit Trading Platform Market technology will dominate the market?

Reason to purchase this Carbon Credit Trading Platform Market Report:

- •Determine prospective investment areas based on a detailed trend analysis of the global Carbon Credit Trading Platform Market over the next years.

- •Gain an in-depth understanding of the underlying factors driving demand for different global Carbon Credit Trading Platform Market segments in the top spending countries across the world and identify the opportunities each offers.

- •Strengthen your understanding of the market in terms of demand drivers, industry trends, and the latest technological developments, among others.

- •Identify the major channels that are driving the global global Carbon Credit Trading Platform Market , providing a clear picture of future opportunities that can be tapped, resulting in revenue expansion.

- •Channelize resources by focusing on the ongoing programs that are being undertaken by the different countries within the global global Carbon Credit Trading Platform Market.

- •Make correct business decisions based on a thorough analysis of the total competitive landscape of the sector with detailed profiles of the top global Carbon Credit Trading Platform Market providers worldwide, including information about their products, alliances, recent contract wins, and financial analysis wherever available.

TOC

Table and Figures

Methodology:

At MarketDigits, we take immense pride in our 360° Research Methodology, which serves as the cornerstone of our research process. It represents a rigorous and comprehensive approach that goes beyond traditional methods to provide a holistic understanding of industry dynamics.

This methodology is built upon the integration of all seven research methodologies developed by MarketDigits, a renowned global research and consulting firm. By leveraging the collective strength of these methodologies, we are able to deliver a 360° view of the challenges, trends, and issues impacting your industry.

The first step of our 360° Research Methodology™ involves conducting extensive primary research, which involves gathering first-hand information through interviews, surveys, and interactions with industry experts, key stakeholders, and market participants. This approach enables us to gather valuable insights and perspectives directly from the source.

Secondary research is another crucial component of our methodology. It involves a deep dive into various data sources, including industry reports, market databases, scholarly articles, and regulatory documents. This helps us gather a wide range of information, validate findings, and provide a comprehensive understanding of the industry landscape.

Furthermore, our methodology incorporates technology-based research techniques, such as data mining, text analytics, and predictive modelling, to uncover hidden patterns, correlations, and trends within the data. This data-driven approach enhances the accuracy and reliability of our analysis, enabling us to make informed and actionable recommendations.

In addition, our analysts bring their industry expertise and domain knowledge to bear on the research process. Their deep understanding of market dynamics, emerging trends, and future prospects allows for insightful interpretation of the data and identification of strategic opportunities.

To ensure the highest level of quality and reliability, our research process undergoes rigorous validation and verification. This includes cross-referencing and triangulation of data from multiple sources, as well as peer reviews and expert consultations.

The result of our 360° Research Methodology is a comprehensive and robust research report that empowers you to make well-informed business decisions. It provides a panoramic view of the industry landscape, helping you navigate challenges, seize opportunities, and stay ahead of the competition.

In summary, our 360° Research Methodology is designed to provide you with a deep understanding of your industry by integrating various research techniques, industry expertise, and data-driven analysis. It ensures that every business decision you make is based on a well-triangulated and comprehensive research experience.

• Product Planning Strategy

• New Product Stratergy

• Expanded Research Scope

• Comprehensive Research

• Strategic Consulting

• Provocative and pragmatic

• Accelerate Revenue & Growth

• Evaluate the competitive landscape

• Optimize your partner network

• Analyzing industries

• Mapping trends

• Strategizing growth

• Implementing plans

Covered Key Topics

Growth Opportunities

Market Growth Drivers

Leading Market Players

Company Market Share

Market Size and Growth Rate

Market Trend and Technological

Research Assistance

We will be happy to help you find what you need. Please call us or write to us:

+1 510-730-3200 (USA Number)

Email: sales@marketdigits.com