- Home

- Automotive & Transportation

-

Automotive Differential Market

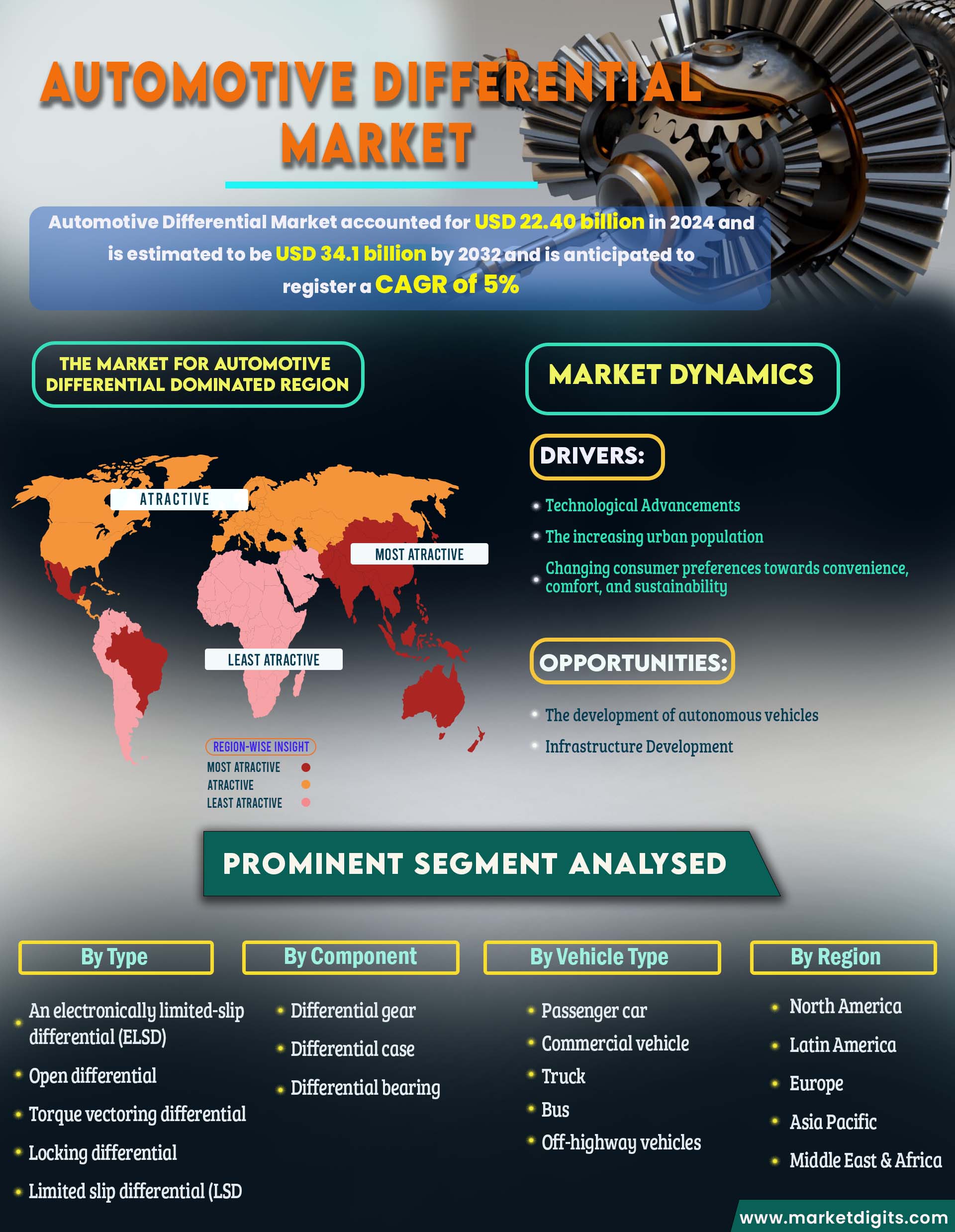

Automotive Differential Market by Drive Type (FWD, RWD, 4WD/AWD), OE Component, On- & Off-Highway Vehicle, Electric Vehicle, Aftermarket Type (Open, Locking, Limited Slip, Electronic Limited Slip, Torque-Vectoring) - Partner & Customer Ecosystem (Product Services, Proposition & Key Features) Competitive Index & Regional Footprints by MarketDigits - Forecast 2024 – 2032

Industry : Automotive & Transportation | Pages : 173 Pages | Upcoming : Jun 2024

The Global Automotive Differential Market, valued at $20.0 billion in 2022, is projected to reach $23.7 billion by 2030, with a compound annual growth rate (CAGR) of 3.5% during the forecast period from 2023 to 2030.

The market growth in the automotive differential sector can be attributed to the increasing demand for premium SUVs, which offer advanced comfort and automatic safety features. SUVs provide benefits such as better maneuverability, larger space, and enhanced comfort compared to sedans, leading to a growing consumer preference for SUVs in both developing and developed countries.

Furthermore, there is a significant growth opportunity for differentials in the heavy trucks segment due to the rising demand for heavy-duty engines in construction and infrastructure projects. The increasing level of farm mechanization has also contributed to the demand for differentials in agricultural tractors. Additionally, the rapid urbanization and the growth of e-commerce and logistics activities have stimulated the forklift market, further driving the demand for differentials in these off-highway vehicles.

Overall, these factors present substantial growth potential for differential manufacturers in various segments, including premium SUVs, heavy trucks, agricultural tractors, forklifts, and other off-highway vehicles.

Automotive Differential Market Dynamics

DRIVER: The rising in demand for commercial and Heavy-Duty Vehicles

The global demand for heavy commercial and light commercial vehicles has witnessed a significant rise in recent years. This growth can be attributed to various factors, including increased logistics and transportation activities, industrialization, rising e-commerce demand, and the overall economic growth of both developed and developing countries. In the heavy trucks market, Asia Pacific holds the dominant position, accounting for approximately 79% of the total global demand. This region's strong market share is primarily driven by factors such as rising industrialization, infrastructure development, and manufacturing growth. As a result, the demand for heavy trucks in Asia Pacific is expected to remain robust in the future, sustaining the growth of the automotive differential market.

Most heavy trucks are designed as rear-wheel drives, with some models offering additional options such as all-wheel drive or 4WD (4x4, 6x4, 8x4, 8x6, etc.). The differentials in commercial vehicles are typically installed on live or drive axles. Therefore, the number of differentials used in a vehicle is directly related to the number of drive axles it possesses. Front-wheel drive (FWD) and rear-wheel drive (RWD) configurations require a single differential, while all-wheel drive or 4-wheel drive systems may require 2-3 differentials due to the presence of multiple live axles. Several commercial vehicle manufacturers, such as Volvo Trucks, EZ Trac, and Tata Motors, are producing heavy commercial vehicles equipped with 4WD and AWD systems. Notable examples of heavy trucks featuring AWD/4WD systems include Tata Novus, Volvo FMX, and Freightliner M2.

Consequently, the growing market for heavy trucks with AWD/4WD systems across different regions will drive the demand for automotive differentials. This presents a significant opportunity for automotive differential manufacturers, particularly in the heavy-duty commercial vehicle segment.

RESTRAINT: Rise in demand for electric passenger cars and commercial vehicles

Electric vehicles (EVs) require different types of differentials compared to traditional internal combustion engine (ICE) vehicles. The heavy-weight and unsuitability of traditional mechanical differentials for EVs necessitate the use of alternative options. Commonly, electric vehicles utilize automatic limited-slip differentials, automatic locking differentials, and electronically selectable locking differentials. These differentials operate based on command signals from the steering wheel, throttle position, and motor speed, allowing for the distribution of torque to each wheel according to desired power requirements. Consequently, the increasing adoption of EVs may have a negative impact on the market growth of traditional differential suppliers catering to ICE vehicles.

OPPORTUNITY: Advancement in differential technology

The surge in sales of electric and hybrid vehicles has generated a demand for various electrical components, including electrical differentials, traction motors, electric compressors, batteries, power electronics, and e-beam axles. Unlike conventional vehicles that typically require multi-speed transmissions, electric vehicles predominantly use single-speed transmissions. While a gearbox transfers power from electric motors to the wheels in EVs, the differential employed in these vehicles provides variable torque to the rotating wheels, especially during turns. The mechanical differential is gradually being replaced by electronically controlled differentials, enabling precise torque distribution.

Electric limited-slip differentials, controlled by electronic control units, offer ample torque to the wheels with the most traction, making them particularly effective on slippery roads. This system enhances handling during high-speed curves and lane changes. Mitsubishi's Active Center Differential, for example, allows drivers to choose presets tailored to road, gravel, and snow conditions. Tier-1 suppliers such as American Axle & Manufacturing offer a portfolio of TracRite differentials that enhance comfort and improve performance in battery electric vehicles, including pickup trucks and SUVs. Other major global suppliers, including Eaton, Dana Inc., and American Axle, have also begun focusing on developing differentials for electric vehicles. As vehicle electrification continues to expand, the demand for differentials in electric vehicles is expected to grow rapidly. This presents lucrative business opportunities for differential suppliers to develop electronic limited-slip differentials, automatic locking differentials, torque-vectoring differentials, and other solutions tailored to the needs of original equipment manufacturers (OEMs).

CHALLENGE: Presence of local and Regional Suppliers.

Established and prominent players such as Eaton Plc, Dana Inc., American Axle & Manufacturing Company, Linamar Corporation, and GKN driveline offer a wide range of differential products and other driveline components for the OE market. These companies are actively looking after sales service support for this product. With rise in passenger cars and heavy commercial vehicles the opportunity of automotive differential would also increase.

Furthermore, alongside these well-established players, several local and regional companies such as Amtech International, Auburn Gear, and PowerTrax are also involved in manufacturing automotive differential components for passenger cars, commercial vehicles, and buses. These local and regional players primarily focus on meeting the aftermarket demand for automotive differentials, thereby creating competition for established companies. They offer differentials and their components at lower costs compared to well-established players, posing a challenge for these established companies. Moreover, the increasing adoption of electric vehicles will lead to the replacement of traditional mechanical differentials with electrical differentials, which will impact the revenue of companies manufacturing mechanical differentials for ICE vehicles.

The heavy trucks segment is anticipated to exhibit the highest growth rate during the forecast period. Heavy trucks are expected to experience rapid growth in the automotive differential market. These trucks are designed to carry heavy loads and require superior pulling capacity, necessitating drivers to have better control over the vehicle compared to passenger cars. The type of differential installed in trucks varies based on the axle configuration, with the number of differentials corresponding to the number of live axles in the trucks. As a result, most heavy trucks are rear-wheel drive, and rear-wheel drive configurations are prevalent in trucks and semi-trailers weighing up to 25-30 tons. Additionally, a few original equipment manufacturers (OEMs) such as Freightliner, Acela Truck, Mercedes Benz, Volvo, and MAN Trucks, among others, are offering 4WD/AWD trucks in Europe and North American countries. Therefore, the rising industrialization and the growth of e-commerce and logistics activities will simultaneously drive the demand for heavy trucks and differentials in this segment.

The largest segment in the electric and hybrid vehicle differential market is anticipated to be the plug-in hybrid vehicle (PHEV) segment. PHEVs are expected to hold a significant share in the market due to their ability to bridge the gap between internal combustion engine (ICE) vehicles and fully electric cars, offering optimal fuel performance along with improved overall performance, comfort, and safety features. Major PHEV manufacturers such as Toyota Motor Corporation, Volkswagen AG, Mercedes-Benz, BMW Group, Mitsubishi Motors, BYD Company Ltd., and Li Auto have introduced several plug-in hybrid SUVs that have garnered high demand in the market. In 2021, the Toyota RAV4 was the top-selling PHEV outside of China, followed by the Mitsubishi Outlander. These plug-in hybrid SUVs and premium cars are typically equipped with rear-wheel drive (RWD) or all-wheel drive (AWD)/four-wheel drive (4WD) systems, and they often incorporate open differentials, electronic limited-slip differentials (ELSD), and torque-vectoring differentials. For example, models like the RAV4 Hybrid and the 2019 Prius AWD feature advanced AWD-i systems to enhance handling in slippery conditions. With leading European and American original equipment manufacturers (OEMs) planning to release more PHEVs in the future, the market for differentials in PHEVs is expected to experience significant growth.

Within the tractor differential market, the largest segment is projected to be the two-wheel drive segment. This can be attributed to the high demand for small tractors in key countries such as China, India, and the USA. These countries have relatively smaller farming land and lower levels of mechanization, particularly in China and India, leading to a preference for two-wheel drive tractors. Two-wheel drive tractors typically incorporate a single unit of differential. As the agricultural sector faces challenges such as a lack of skilled farm labor, increasing labor costs, and a growing need for operational efficiency and profitability, the demand for differentials in the two-wheel drive tractor segment is expected to rise.

The automotive differential market in the Asia Pacific region holds a dominant position. This can be attributed to various factors, including the increasing demand for vehicles driven by changing consumer preferences, the rising per capita income of the middle-class population, and cost advantages offered to global original equipment manufacturers (OEMs). Among the Asia Pacific countries, China, Japan, and India are experiencing significant market growth. China, in particular, is projected to be the largest market for automotive differentials due to the high vehicle production and sales in the country. The growing demand for passenger cars in the region has led to an increased consumer preference for comfort and advanced safety features. Additionally, OEMs in the Asia Pacific region are offering SUVs and medium to premium range sedan cars at competitive prices, which has further contributed to the shift in consumer preference towards feature-rich vehicles with a higher price tag. The demand for heavy commercial vehicles has also witnessed a surge, driven by increased government infrastructure spending, growth in road and construction projects, real estate investments, and the expansion of e-commerce activities. As a result, the rising vehicle production and consumer inclination towards advanced safety and comfort features present lucrative growth opportunities for the automotive differential market in the coming years.

Key market players in the automotive differential market include GKN Driveline, Eaton Plc, American Axle & Manufacturing Company, Dana Incorporation, Linamar Corporation, and BorgWarner Inc. These companies have adopted strategies such as new product launches and expansion to gain traction in the automotive differential market.

This report categorizes the automotive differential market based on factors such as differential type, drive type, vehicle type, component, electric and hybrid vehicle differential by differential type, component (aftermarket), off-highway differential market by equipment type, and region.

By Differential Type (ICE)

• Open

• Locking

• Limited Slip

• Electronic Limited Slip

• and Torque-Vectoring

By Drive Type

• Front Wheel Drive

• Rear Wheel Drive and All Wheel Drive/ 4 Wheel Drive

By Vehicle Type (ICE)

• Passenger Car

• LCV, Truck and Buses

By Component (OE)

• Pinion Gear

• Side Gear

• Ring Gear

• Differential Housing

• and Differential Bearing

Electric & Hybrid Vehicle differential, By Differential Type

• Open

• Locking

• Limited Slip

•Electronic Limited Slip and Torque-Vectoring

By EV Type

PHEV and FCEV

By Component (Aftermarket)

• Differential Bearings

• Differential Gears

• Differential Gaskets

• and Differential Seals

• Off-highway differential market, By Equipment Type

• Agricultural Tractors and Forklift

By Region

• Asia Pacific

• Europe

• North America

• and ROW

Recent Developments

• In June 2023, the company announced its plans to supply an electric drive unit to the Mercedes-AMG GT 63 S E Performance. The electric drive unit from AAM is designed to deliver exceptional vehicle performance in a compact and power-dense package. It features an innovative design that includes an electromechanical actuated two-speed gearbox and an electromechanical controlled limited slip differential (eLSD), offering quick shifting times and enhanced traction.

• In January 2023, Dana Inc. unveiled new planetary drives that offer improved torque density and design flexibility for a wide range of applications, including wheeled, tracked, and winch applications. These planetary drives can be integrated with Dana TM4 electric motors, catering to both conventional and electrified machines such as crawler cranes, piling rigs, drill rigs, and track tool carriers.

• In August 2021, Eaton introduced an extensive lineup of specialized differentials designed for electrified vehicles, offering comparable performance to traditional internal combustion engine (ICE) vehicles. This range of differentials includes automatic limited-slip, automatic locking, and electronically selectable locking differentials.

• In July 2021, GKN Automotive intensified its efforts in developing e-Drive technologies to meet the growing global demand for electrified vehicles. Their future eDrive technologies, utilizing 800V technology, offer several benefits for electric vehicle (EV) owners, including faster charging times and superior performance.

• In July 2021, Eaton Vehicle Group launched an aftermarket Elocker differential specifically designed for Jeep Wrangler and Gladiator JT models equipped with both manual and automatic transmissions. These electric locking differentials provide a reliable solution for off-road enthusiasts, requiring only one wire for activation and eliminating the need for additional components like airlines and compressors.

• In August 2020, Eaton introduced an electronically controlled, scalable limited-slip differential that can be utilized across multiple vehicle platforms to enhance performance and ensure driver safety.

• In February 2020, GKN developed a two-speed transmission and torque vectoring system for the Jeep Renegade model. The 'GTD19' demonstrator underwent extensive testing in Arieplog, Sweden, showcasing how automakers can leverage drivetrain innovations to achieve industry-leading standards of efficiency, safety, and driving dynamics in battery electric vehicle (BEV) models.

TOC

Table and Figures

Methodology:

At MarketDigits, we take immense pride in our 360° Research Methodology, which serves as the cornerstone of our research process. It represents a rigorous and comprehensive approach that goes beyond traditional methods to provide a holistic understanding of industry dynamics.

This methodology is built upon the integration of all seven research methodologies developed by MarketDigits, a renowned global research and consulting firm. By leveraging the collective strength of these methodologies, we are able to deliver a 360° view of the challenges, trends, and issues impacting your industry.

The first step of our 360° Research Methodology™ involves conducting extensive primary research, which involves gathering first-hand information through interviews, surveys, and interactions with industry experts, key stakeholders, and market participants. This approach enables us to gather valuable insights and perspectives directly from the source.

Secondary research is another crucial component of our methodology. It involves a deep dive into various data sources, including industry reports, market databases, scholarly articles, and regulatory documents. This helps us gather a wide range of information, validate findings, and provide a comprehensive understanding of the industry landscape.

Furthermore, our methodology incorporates technology-based research techniques, such as data mining, text analytics, and predictive modelling, to uncover hidden patterns, correlations, and trends within the data. This data-driven approach enhances the accuracy and reliability of our analysis, enabling us to make informed and actionable recommendations.

In addition, our analysts bring their industry expertise and domain knowledge to bear on the research process. Their deep understanding of market dynamics, emerging trends, and future prospects allows for insightful interpretation of the data and identification of strategic opportunities.

To ensure the highest level of quality and reliability, our research process undergoes rigorous validation and verification. This includes cross-referencing and triangulation of data from multiple sources, as well as peer reviews and expert consultations.

The result of our 360° Research Methodology is a comprehensive and robust research report that empowers you to make well-informed business decisions. It provides a panoramic view of the industry landscape, helping you navigate challenges, seize opportunities, and stay ahead of the competition.

In summary, our 360° Research Methodology is designed to provide you with a deep understanding of your industry by integrating various research techniques, industry expertise, and data-driven analysis. It ensures that every business decision you make is based on a well-triangulated and comprehensive research experience.

• Product Planning Strategy

• New Product Stratergy

• Expanded Research Scope

• Comprehensive Research

• Strategic Consulting

• Provocative and pragmatic

• Accelerate Revenue & Growth

• Evaluate the competitive landscape

• Optimize your partner network

• Analyzing industries

• Mapping trends

• Strategizing growth

• Implementing plans

Covered Key Topics

Growth Opportunities

Market Growth Drivers

Leading Market Players

Company Market Share

Market Size and Growth Rate

Market Trend and Technological

Research Assistance

We will be happy to help you find what you need. Please call us or write to us:

+1 510-730-3200 (USA Number)

Email: sales@marketdigits.com